One Investment Unlocks the World

of Venture Capital

invest now

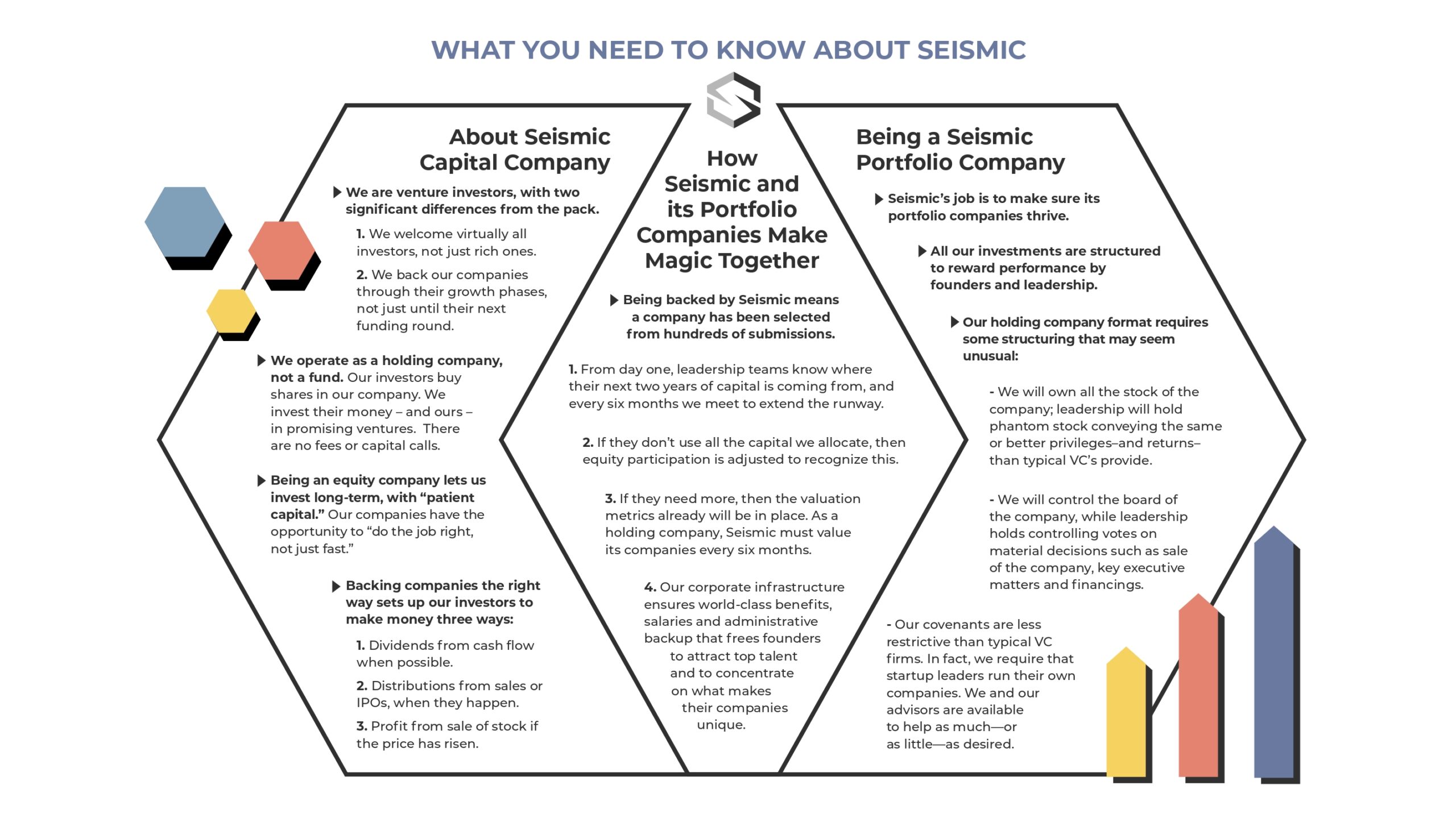

There’s even more you need to know about Seismic.

View our full diagram here.

There’s even more you need to know about Seismic.

View our full diagram here.

Our investment process seeks potential unicorns (private companies that reach a $1 billion valuation) who we have determined have the potential to really “shake up” their industries.

Our aim is to invest in these startups and support their growth with patient capital.

Our research and experience informs us that companies often get bogged down in the minutia of operations, rather than innovating—in other words, startups get stuck in the “business of running a business”.

Seismic is more than just a group of investors. We provide each company in our portfolio with an administrative backbone. Additional support is provided by our hand-selected advisory board to guide our companies to their full potential, aiming to generate tremendous growth within each company and value for our shareholders.

Venture capital investments have long outperformed the public market, creating significant wealth for investors. However, these investments have historically only been accessible to institutions, such as college endowments, and the ultra-wealthy—that is, until now.

Venture capital investments have long outperformed the public market, creating significant wealth for investors. However, these investments have historically only been accessible to institutions, such as college endowments, and the ultra-wealthy—that is, until now.

%20retu.png)

Seismic is a different kind of venture capital investment: our mission includes expanding access to investments in innovative, high potential startups to more than just the 1%. We’re building a portfolio of companies intent on shaking up their industries.

With a minimum investment of just $2,500, individual investors can now invest in a diversified portfolio of startups. Each company is hand selected by our team. We believe that each of them will grow into key industry players.

1 Cambridge Associates, “Private Investments: AMAC Private Investments Subcommittee”, 2020

2 David, Thurston, and Maureen Austin. “Venture Capital Positively Disrupts Intergenerational Investing.” Cambridge Associates, 2020.

Evolectric – Fast Track to the Future of Transportation

Our latest LOI for a portfolio company is a firm in the electric vehicle space with a focus on fleet trucks.

Seismic has agreed to provide limited support to Evolectric, a Long Beach, California-based technology firm specializing in electrified transportation and battery technologies that convert small- and mid-size gas-powered fleet trucks to Electric Vehicles.

Our investment team believes Evolectric has an important role to play and can become a leader in clean tech innovation, accelerating EV adoption rates in domestic and emerging markets. The global market for EVs is projected to see massive growth throughout this decade – and Evolectric is primed to make a big splash.

Game Cloud Network (GCN) is positioned to be a leader in mobile game development, hosting, and in-game advertising.

With GCN’s all-in-one RIVIT platform, developers and publishers are able to develop and host games while integrating ads from brands and sponsorships for e-sports events. Creating a centralized platform allows for a more seamless integration of dynamic ads and easier B2B collaboration to reach a wider customer pool.

Initially formed to showcase the world’s first mobile edge game server with Microsoft and AT&T, GCN is led by industry veterans from EA, Microsoft, Acer, and IBM. Seismic Capital Company believes that GCN will be a key player in the infrastructure of the most important trends in the future of gaming.

Choosing Companies, the Right Way

First, we have to be confident that founders can deliver on their vision.

Second, it has to pass our extensive due diligence for:

Industry

Company

Technology

Personnel

Third, we have to see a way to exit, creating outsized returns for our investors.

Only then can a company become a Seismic Capital company.

Seismic Capital Company targets high-potential management teams and entrepreneurs intent on shaking their markets. We look for disruptors who make us ask, “Why didn’t we think of that?”

When you invest in Seismic Capital Company, you are purchasing shares of a Qualified Small Business Stock (QSBS), which shields most investors from capital gains taxes at the federal level (and at most state levels as well)* when they sell their shares.

There is no lock-up or holding period; investors may sell their shares at any time. However, to qualify for the full tax exemption, the holding period is five years and partial exemptions are generally available for a shorter hold.

We also know that management fees cut into investor returns, so there are none. Not now, not ever.

Many funds also force you to keep cash available for them, when they want it - we don’t believe in that, so we don’t do that either.

*Subject to IRS restrictions, please consult your tax professional for personalized advice.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Please read before leaving our site.

You are now leaving the Seismic Capital Company website. Any links to articles or third-party websites that Seismic provides on this site are for your convenience and information only. The content of any linked material is beyond Seismic Capital Company’s control and Seismic is not responsible for, nor has it verified, such content. The content of and/or views in any linked article or third-party website do not necessarily reflect the views of Seismic Capital Company and are not intended as indicators of current or anticipated market/investment performance, investment or other advice, or a solicitation, recommendation or endorsement to buy or sell any securities in any jurisdiction in which such solicitation or offer would be unlawful.

Download our investment guide to get a comprehensive picture of Seismic Capital Company’s offering.

read guide First Thursdays: Qualified Small Business Stock (QSBS)

First Thursdays: Qualified Small Business Stock (QSBS)See Steven and Eric outline Seismic’s unique QSBS TAX-ADVANTAGES and portfolio structure.

Seismic’s Commitment to Sustainability

Seismic’s Commitment to SustainabilityA little ethics goes a long way – how we aim to improve our bottom line while improving the world.

The Seismic Capital Company leadership team‘s decades of business experience—in finance, technology, leadership, mentoring, marketing, sales, HR, and more—allow it to guide and nurture its portfolio companies.

Advising means more than attending quarterly board meetings. Our management team works extensively with our companies and hand-selects a team of advisors to help them achieve their full potential.

Steven Weinstein

CEO, Member of Investment Committee

Named a CEO Visionary by the LA Business Times, Steven puts his vast experience to work in leading Seismic as it seeks to uncover the world's next unicorns. Throughout his career, Steven has been at the forefront of technological innovation and process improvement. The CEO of Seismic led the teams that put real-time information into formally static apps, started artificial intelligence processing in the creation of news stories, and developed the first hypertext links into news articles. These innovations lead to practices that we consider customary today. Frequently ahead of his time, he started and led a messaging company before mass marketing by email, SMS, and other electronic means became popular. He has raised significant capital for ventures from technology to real estate.

Alice Neuhauser

CFO

Named LA Business Journal CFO of the year in the “Small Private Business” category and a Finalist for the LA Business Times Rising Star Award, Alice’s talents and experience are leveraged by Seismic Capital’s investment committee and portfolio companies. Alice manages the internal and external procedures of Seismic. Building on her previous experience on behalf of lenders such as JPMorgan Chase, where she stepped into executive management of distressed clients, she has seen companies develop problems and knows the pitfalls to avoid. Those experiences provide a deep understanding of how start-ups can succeed. Her operational and regulatory compliance oversight is foundational to her work with Seismic. She oversees the Cap Table with Seismic's transfer agent, coordinates accounting books and records with the company's CPA firm, and manages compliance with Seismic's auditor and regulatory filings with the SEC. She also handles banking, IRA, and broker-dealer relationships. She will be overseeing the integration of Seismic's portfolio companies as they are brought into the portfolio, providing accounting, HR, and other services so those firms can squarely focus their efforts on building products and growing revenue.

Eric White

President, Chief Investment Officer

After spending years as an investment banker with billions of dollars of successful transactions for prominent firms, Eric puts his expertise to work at Seismic Capital as he leads the investment team and advisory board seeking innovative megatrends and the companies he believes can participate in them, aiming to shake up their industries and profits for our shareholders. His experience includes being a founder of a hugely successful Silicon Valley tech company, an advisor to venture capital and private equity firms, and leading a Washington, DC public affairs and advisory firm focused on technology, gaming, media, communications, transportation, banking, and small business.

Steven Weinstein

CEO, Member of Investment Committee

Alice Neuhauser

CFO

Eric White

President, Chief Investment Officer

The Seismic Capital Company advisory board features a suite of professionals from various industries and disciplines, creating an extensive network of expertise and knowledge for mentorship, support, and new opportunities. Seismic companies’ ability to lean on a deep bench of industry veterans and their contacts provides a customized mentorship team for each portfolio company.